Introduction

How Super Payments can help your business.

Free payments

You're on your way to integrating our processing fee-free payment solution into your business.

For every online purchase made by a consumer, businesses are charged a fee by their service provider, anywhere between 1% and 7%.

Super Payments was formed to empower businesses by providing processing fee-free payments - with some of the savings passed onto customers to drive sales growth, on average a 30% increase in sales.

Visa, Mastercard, corporate and EU card processing, alongside pay-by-bank, and Buy Now Pay Later are 0%. Super offers a range of optional paid add-ons including Amex and same-day settlement - you can decide to turn these on or off at any time. Unavoidable card costs (scheme + interchange, mandated by Visa/Mastercard and the issuing banks) are still charged.

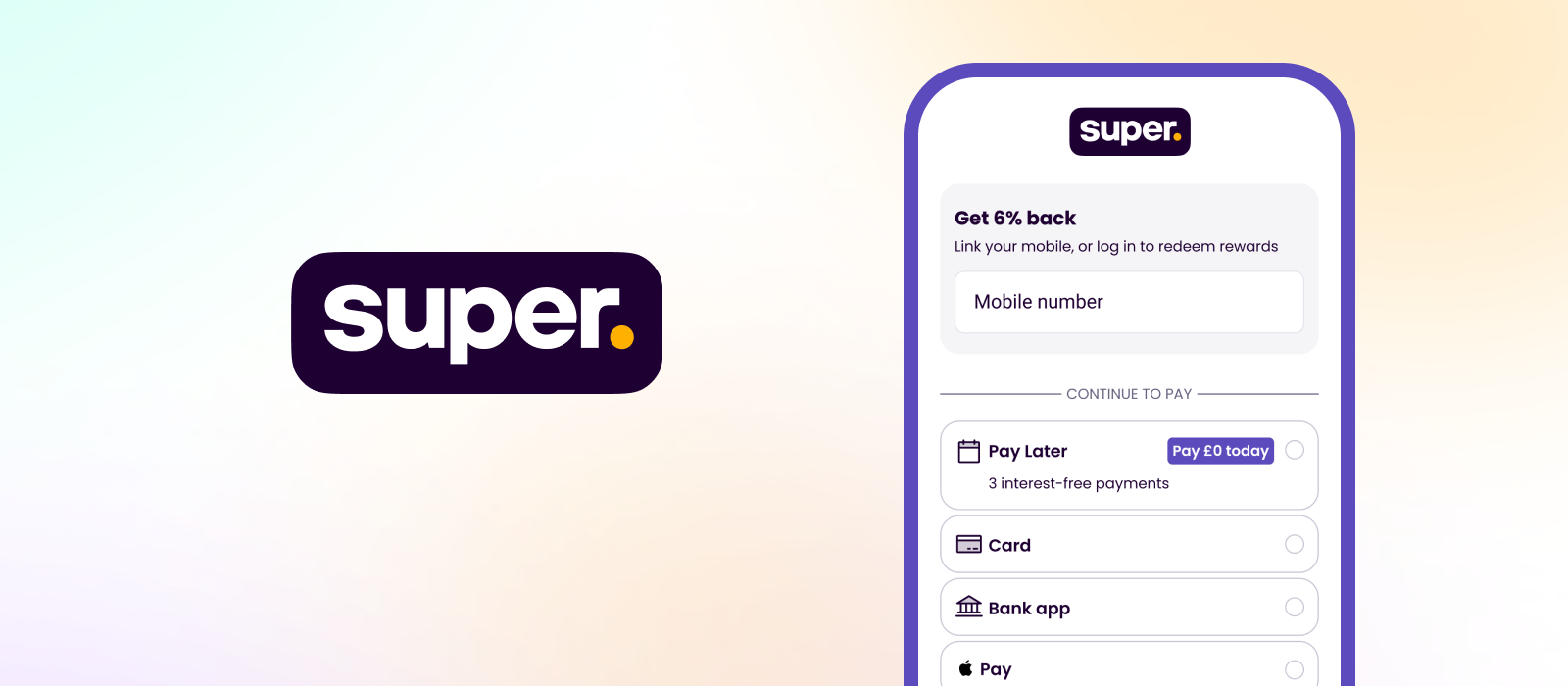

Sales growth with Cash Rewards

Super Payments empowers businesses with processing fee-free payments, allowing them to offer customers a % Cash Reward, which is automatically deducted from their next purchase if, and only if they return to your store and pay with Super. By rewarding customers in this way, they shop more often and buy more with a business, boosting customer loyalty and retention.

About Super Payments

Super Payments was founded by Samir Desai CBE, founder of Funding Circle, and a team of experienced executives to transform the online shopping experience with a new way to pay and shop.

We're backed by the investors behind Facebook, Spotify, Stripe, Monzo and Twitter.

Using Super PaymentsSuper Payments integrates with all the main e-commerce platforms, including custom integrations via an API, and is compatible with all the major banking platforms.

Integration is simple. Getting Started here and you'll be up and running taking free payments for your business in minutes.

Updated about 2 months ago